Shared equity mortgage bad credit

A ten percent down payment is mandatory for those with a score of 500. Ad No Monthly Payments.

Home Equity Sharing Here Are The Pros And Cons Money

Ad Give us a call to find out more.

. Ad When Banks Say No We Say Yes. A home equity shared agreement is an exchange between you and an investment company where you receive a lump sum cash payment in exchange for a portion of your. Theyre often run by government or non-profit organizations to provide first-time or low- to.

Ad Compare Top home Equity Lenders. A mortgage with mere 35 percent down payment it likely for those with a credit score of 580 or higher. A shared equity mortgage is an arrangement under which a lender and a borrower share ownership of a property.

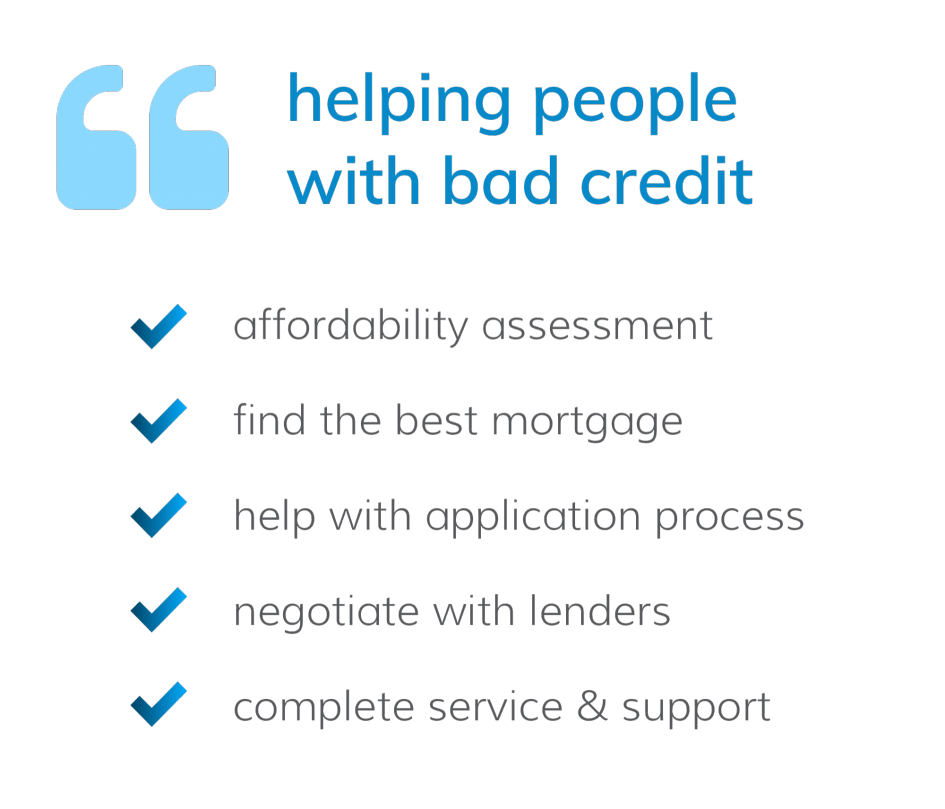

However the amount of ownership depends on the. Home Equity Line of Credit HELOC. Getting a shared ownership mortgage with bad credit is possible with the correct approach.

Shared equity programs can provide an excellent opportunity for affordable homeownership. So it cost them 96074 144073-48000 to borrow 48000 for 10 years. Share of the homes future value.

Itll be more difficult than if you had a perfect credit score but its. Ad See If You Qualify For Reverse Mortgage Loans. The borrower must occupy the property.

You must also qualify for the scheme before applying for a mortgage. Tap Into Your Home Equity Without the Burden of Additional Debt. First mortgages pay for the purchase of a home whereas home equity loans or second mortgages.

Yes you can get a Shared Ownership mortgage with bad credit. Can I get a Shared Ownership Mortgage with Bad Credit. Compare Top Lenders Today.

The specific percentage is based on how much cash you receive up front. Create years of memories in your home. Hometap gets paid a 5 to 25 share of the homes value when the contract ends.

Trade a portion of your home equity for cash then use your funds how you want from paying debt to funding retirement. Borrow From Your Home And Enjoy The Retirement You Deserve With A Reverse Mortgage. What is a Shared Equity Agreement and How Does It Work.

A shared equity mortgage refers to an arrangement where the lender and borrower both have ownership of the property. Ad When Banks Say No We Say Yes. Ad Give us a call to find out more.

Stated Income Make Sense Underwriting Fast Close. Mortgages and home equity loans are available to consumers with bad credit. If they sell their home at that time they owe 75 of the 192098 144073 to the investor.

Apply Today Get Low Rates. Lets say you have a home worth 500000 with a 200000 mortgage giving.

Accessing Mortgage Financing Options For Buyers Of Shared Equity Homes Grounded Solutions Network

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

5 Best Home Equity Sharing Companies August 2022 Lendedu

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Bad Credit And Large Deposits How To Lower The Risk

Unlock Review 2022 Bankrate

Second Mortgage Loans Vs Heloc Visual Ly

How To Get A Home Equity Loan If You Have Bad Credit Nerdwallet

5 Best Loans For Bad Credit Of 2022 Money

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto

Home Equity Loans Home Loans U S Bank

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Can I Get A Shared Ownership Mortgage With Bad Credit Haysto